- Aetna Emergency Room Copay

- Medicare Emergency Room Copay

- What Does Emergency Room Copay Cover

- Does Unitedhealthcare Community Plan Cover Emergency Room Visits

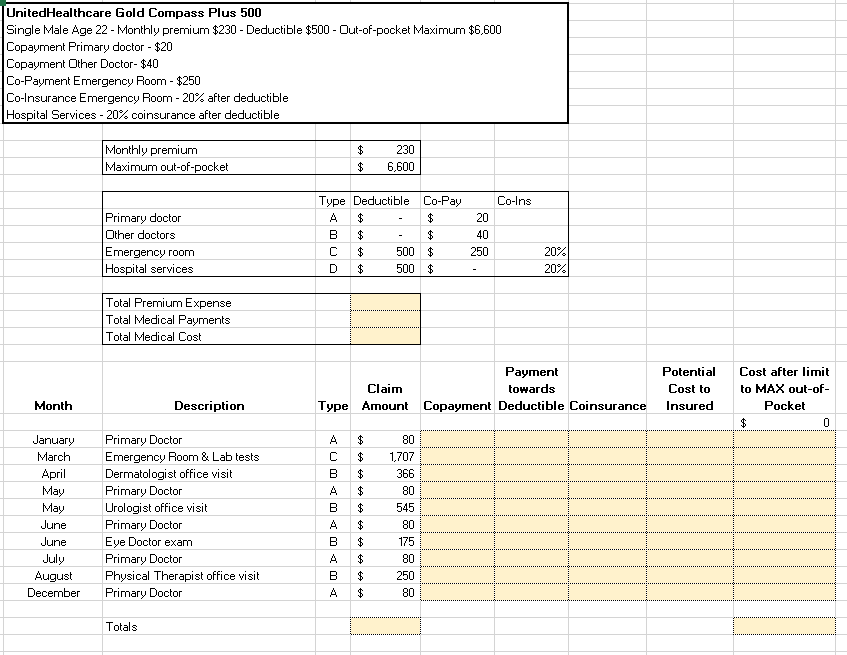

- United Healthcare Emergency Room Copay

- United Healthcare Emergency Care

| MEDICAL PLAN | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Plan | Low-Deductible | Low-Deductible | Balanced | Balanced | Low-Premium | Low-Premium | Low-Deductible | Balanced | Low-Premium | WellMed 1st Tier*** Tier 1/2 | UHC of Nevada HMO | UHC of Nevada POS Tier 1/2 Coverage | SignatureValue | SignatureValue Harmony | Hawaii PPO | Accountable Care | Bind | Monument Health 2,000/4,000 **** Tier 1/Tier 2 Coverage | Doctors | M Health Fairview – Primary Care | SignatureValue Advantage | Kelsey-Seybold Primary Care |

| In-Network Benefits | ||||||||||||||||||||||

| ANNUAL DEDUCTIBLE | ||||||||||||||||||||||

| Individual | $1,400 | $1,400 | $2,800 | $2,800 | $3,300 | $3,300 | $1,400 | $2,800 | $3,300 | $0/$1,250 | $1,000 | $0/$1,000 | $0 | $0 | $150 | $1,100 | $0 | $2,000/$4,000 | $1,100 | $500 | $0 | $500 |

| Family | $2,800 | $2,800 | $5,600 | $5,600 | $6,600 | $6,600 | $2,800 | $5,600 | $6,600 | $0/$2,500 | $2,000 | $0/$2,000 | $0 | $0 | $450 | $2,200 | $0 | $4,000/$8,000 | $2,200 | $1,000 | $0 | $1,000 |

| HSA COMPANY CONTRIBUTION | ||||||||||||||||||||||

| Employee-only | $500 | $500 (Choice Plus Network) $1,000 (Advocate Network) | $500 | $500 (Choice Plus Network) $1,000 (Advocate Network) | $500 | $500 (Choice Plus Network) $1,000 (Advocate Network) | $500 (Choice Plus Network) $1,000 (Kelsey-Seybold Network) | $500 (Choice Plus Network) $1,000 (Kelsey-Seybold Network) | $500 (Choice Plus Network) $1,000 (Kelsey-Seybold Network) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Family | $1,000 | $1,000 (Choice Plus Network) $2,000 (Advocate Network) | $1,000 | $1,000 (Choice Plus Network) $2,000 (Advocate Network) | $1,000 | $1,000 (Choice Plus Network) $2,000 (Advocate Network) | $1,000 (Choice Plus Network) $2,000 (Kelsey-Seybold Network) | $1,000 (Choice Plus Network) $2,000 (Kelsey-Seybold Network) | $1,000 (Choice Plus Network) $2,000 (Kelsey-Seybold Network) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| COINSURANCE | ||||||||||||||||||||||

| After Deductible | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | $0/30% | 20% | $0/30% | 20% | 20% | 10% | 20% | N/A | 20%/40% | 20% | 20% | N/A | 20% |

| OFFICE VISIT* | ||||||||||||||||||||||

| Primary Care | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | $20 copay/30% | $15 copay | $15/$35 copay | $40 copay | $10 copay | 10% | Tier 1: $20 copay Other In-Network: 50% | Average $40 copay | Tier 1: $15 (first three visits covered at 100%) Tier 2: $40 | Covered 100% | $20 copay | $10 copay | $20 copay |

| Specialist | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | $30 copay/30% | $30 copay | $30/$55 copay | $55 copay | $35 copay | 10% | Tier 1: $30 copay Other In-Network: 50% | up to $85 copay | $50 copay | $100 copay | $30 copay | $35 copay | $30 copay |

| Preventive Care | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% | Covered 100% |

| URGENT CARE* | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | $50 copay/30% | $30 copay | $40 copay | $40 copay | $10 copay | 10% | $50 copay | $150 copay | $50 copay | Covered 100% | $50 copay | $10 copay | $50 copay |

| EMERGENCY ROOM COVERAGE FOR EMERGENCY SITUATIONS* | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | 20% | $300 copay | 20% | $500 copay | $300 copay | $200 copay | 10% | $300 copay | $400 copay | $150 copay then 20% | $500 copay plus 20% | $300 copay | $200 copay | $300 copay |

| OUT-OF-POCKET MAX | ||||||||||||||||||||||

| Individual | $4,200 | $4,200 | $5,600 | $5,600 | $6,600 | $6,600 | $4,200 | $5,600 | $6,600 | $3,550 | $6,250 | $6,850 | $5,000 | $3,500 | $2,650 | $4,000 | $6,000 | $6,000 | $5,000 | $3,300 | $3,500 | $3,300 |

| Family | $8,400 | $8,400 | $11,200 | $11,200 | $13,200 | $13,200 | $8,400 | $11,200 | $13,200 | $10,650 | $12,500 | $13,700 | $15,000 | $7,000 | $7,950 | $8,000 | $12,000 | $12,000 | $10,000 | $6,600 | $7,000 | $6,600 |

* Coinsurance percentage applies after deductible.

*** WellMed 1st Tier is only available to employees assigned to work in the WellMed business unit who reside or work in certain locations in San Antonio. If you are eligible for the WellMed 1st Tier option, it will be reflected in the benefits enrollment site.

This service should not be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room. The information provided through this service is for informational purposes only. The nurses cannot diagnose problems or recommend treatment and are not a. Virtual Visit Introduction. Hospital services (inpatient) $200 copay per admission: Hospital services (outpatient) 4% coinsurance after deductible: Urgent care. Hearing aid: $500 reimbursement. Hearing aid reimbursement claim form.

UnitedHealthcare may modify this reimbursement policy from time to time by publishing a new version of the policy on this Website; however, the information presented in this policy is believed to be accurate and current as of the date of publication. Emergency Department (ED) Facility Evaluation and Management (E&M) Coding Policy.

Here is a high-level summary of the medical plans available in your location.

HSA-eligible plans support your overall health and well-being and are available to all U.S. employees and their families, except those in Hawaii.

Details

- You can see any provider, but you'll save when you use a network provider.

- The HSA-eligible plans use the Choice Plus network, a broad network with coverage for both in-network and out-of-network providers and is available in most areas.

- For most in-network services, you pay the full cost until you’ve met your deductible. Then you’ll pay 20% coinsurance.

- You have three plans to choose from:

- The Low-Deductible Plan has a higher premium, but offers the lowest deductible allowed by the IRS for an HSA-eligible plan. You might want this plan if you prefer to pay more each paycheck in exchange for a lower deductible, or if you expect to incur high medical or prescription drug costs.

- The Balanced Plan offers a moderate premium and deductible. It’s a good choice if you want to balance your health care spending throughout the year.

- The Low-Premium Plan has the lowest premium, but the highest deductible. You may want to consider this plan if you prefer to pay less each paycheck in exchange for higher costs when you receive care.

Health Savings Account

When you enroll in one of the HSA-eligible plans, an Optum Bank Health Savings Account (HSA) will automatically be opened. Visit Health Savings Account to learn more about HSAs.

Prescription Drug Coverage

The HSA-eligible plans use the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor , your 24/7 resource for personalized health care support and guidance.

- Contribute to a Limited-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at

800-357-1371 for more information.

The HSA-eligible medical plans work together with an Optum Bank Health Savings Account(HSA) to help you support your overall health and well-being. You get the most out of your coverage when you actively engage in your health care and decision-making.

Employees and their families who live in select ZIP codes in Chicago, Illinois, have the choice between two networks, the value-based Advocate Health System and the UnitedHealthcare Choice Plus network.

Visit the benefits enrollment site to see your network eligibility.

Details

- For most network services, you pay the full cost until you’ve met your deductible. Then you’ll pay 20% coinsurance.

- You have three plans to choose from:

- The Low-Deductible Plan has a higher premium, but offers the lowest deductible allowed by the IRS for an HSA-eligible plan. You might want this plan if you prefer to pay more each paycheck in exchange for a lower deductible, or if you expect to incur high medical or prescription drug costs.

- The Balanced Plan offers a moderate premium and deductible. It’s a good choice if you want to balance your health care spending throughout the year.

- The Low-Premium Plan has the lowest premium, but the highest deductible. You may want to consider this plan if you prefer to pay less each paycheck in exchange for higher costs when you receive care.

Network Providers

The HSA-eligible plans allow you to pick a network of providers. You can choose a broad network or a value-based network designed to provide better health outcomes and more savings to you. Value-based networks are often referred to as “focused” networks because there are fewer network providers and a primary care physician (PCP) who is entrusted with clinical oversight for care. A focused network features a team‐based approach on prevention, early detection and ongoing intervention of chronic and complex diseases.

When choosing a network for the HSA-eligible plans, consider the following:

| Advocate Health System | Choice Plus Network | |

| Network Type | Focused Download adobe illustrator 2017 torrent mac. Advocate Health System has more than 450 Advocate Health Care locations, 12 acute-care hospitals, more than 5,000 physicians, home health services and outpatient centers. | Broad |

| Network Preventive Care | 100% covered | |

| Network Services | You pay the full cost until you’ve met your deductible. Then you’ll pay 20% coinsurance. | |

| Out-of-network Coverage | There is no coverage for out-of-network services except for emergencies. | You can see any provider, but you'll save significantly more when you use a network provider. The deductible and out-of-pocket maximum is double when you receive services out-of-network. |

| Primary Care Physician (PCP) | Necessary1 | Recommended |

| Referrals to Specialists | Required | Not Required |

| HSA Company Contribution | $1,000 employee-only | $500 employee-only |

1Additional coordination is required if you cover a dependent who lives out of state. Your dependent must have a PCP in the state where you reside and receive a referral from that PCP for services where the dependent lives.

Health Savings Account

When you enroll in one of the HSA-eligible plans, an Optum Bank Health Savings Account (HSA) will automatically be opened. Visit Health Savings Account to learn more about HSAs.

Prescription Drug Coverage

The HSA-eligible plans use the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Limited-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at

800-357-1371 for more information.

Resources

- Visit the Advocate Health System Provider Directory to research in-network physicians and facilities before enrolling

- Visit the Choice Plus Provider Directories to research in-network physicians and facilities before enrolling

The HSA-eligible medical plans work together with an Optum Bank Health Savings Account (HSA) to help you support your overall health and well-being. You get the most out of your coverage when you actively engage in your health care and decision-making. Employees and their families who live in select ZIP codes in Houston, Texas, including Sugarland have the choice between two networks, the Kelsey-Seybold Health System and the UnitedHealthcare Choice Plus network.

Visit the benefits enrollment site to see your network eligibility.

Details

- For most network services, you pay the full cost until you’ve met your deductible. Then you’ll pay 20% coinsurance.

- You have three plans to choose from:

- The Low-Deductible Plan has a higher premium, but offers the lowest deductible allowed by the IRS for an HSA-eligible plan. You might want this plan if you prefer to pay more each paycheck in exchange for a lower deductible, or if you expect to incur high medical or prescription drug costs.

- The Balanced Plan offers a moderate premium and deductible. It’s a good choice if you want to balance your health care spending throughout the year.

- The Low-Premium Plan has the lowest premium, but the highest deductible. You may want to consider this plan if you prefer to pay less each paycheck in exchange for higher costs when you receive care.

Network Providers

The HSA-eligible plans allow you to pick a network of providers. You can choose a broad network or a value-based network designed to provide better health outcomes and more savings to you. Value-based networks are often referred to as “focused” networks because there are fewer network providers and a primary care physician (PCP) is entrusted with clinical oversight for your care. A focused network features a team‐based approach on prevention, early detection and ongoing intervention of chronic and complex diseases.

When choosing a network for the HSA-eligible plans, consider the following:

| Kelsey-Seybold Health System | Choice Plus Network | |

| Network Type | Focused | Broad |

| Network Preventive Care | 100% covered | |

| Network Services | You pay the full cost until you’ve met your deductible. Then you’ll pay 20% coinsurance. | |

| Out-of-network Coverage | There is no coverage for out-of-network services except for emergencies. | You can see any provider, but you'll save significantly more when you use a network provider. The deductible and out-of-pocket maximum is double when you receive services out-of-network. |

| Primary Care Physician (PCP) | Necessary1 | Recommended |

| Referrals to Specialists | Required | Not required |

| HSA Company Contribution | $1,000 employee-only | $500 employee-only |

1Additional coordination is required if you cover a dependent who lives out of state. Your dependent must have a PCP in the state where you reside and receive a referral from that PCP for services where the dependent lives.

Health Savings Account

When you enroll in one of the HSA-eligible plans, an Optum Bank Health Savings Account (HSA) will automatically be opened. Visit Health Savings Account to learn more about HSAs.

Prescription Drug Coverage

The HSA-eligible plans use the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Limited-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at 800-357-1371 for more information.

Resources

- Visit the Kelsey-Seybold Provider Directory to research in-network physicians and facilities before enrolling

- Visit the Choice Plus Provider Directories to research in-network physicians and facilities before enrolling

The Kelsey-Seybold Primary Care Plan is a network-only plan available to eligible employees and their families who live in select ZIP codes in the Houston, Texas service area, including Sugarland, Texas.

The Kelsey-Seybold Primary Care Plan gives you access to a network of providers, hospitals and other health care professionals that delivers coordinated, high-quality, cost-effective care to help you achieve better health outcomes.

To see if you are eligible for the Kelsey-Seybold Primary Care Plan, visit the benefits enrollment site.

Details

- Except for emergencies, benefits are paid only for care or services received from providers in the Kelsey-Seybold network. There is no coverage for out-of-network services.

- You’ll have access to Kelsey-Seybold's hospital partners, including C-H-I St. Luke’s Health, Texas Children’s Hospital and Memorial Hermann.

- You and each enrolled dependent must select a Kelsey Seybold primary care physician (PCP) to coordinate all care, including referrals to specialists.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

- Additional coordination is required if you cover a dependent who lives out of state. Your dependent must have a PCP in the state where you reside and receive a referral from that PCP for services where the dependent lives.

Prescription Drug Coverage

The Kelsey-Seybold Primary Care Plan uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at 800-357-1371 for more information.

SignatureValue HMO is a network-only plan and is available to employees and their families who live in select ZIP codes in California. To see if you are eligible for the SignatureValue HMO, visit the benefits enrollment site.

Details

- No deductible.

- Except for emergencies, benefits are paid only for care or services provided inside the network and when authorized through your Primary Care Physician (PCP).

- Access to the full SignatureValue HMO network for in-network benefits.

- You pay 20% coinsurance for some services

- Your PCP will coordinate all of your care, including referrals to specialists. In most cases, if you see a specialist without a referral from your PCP, it will not be covered.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

And more!

- Prescription drug coverage is provided through the network retail pharmacies and OptumRx home delivery service pharmacy.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Contact Us

- Call UnitedHealthcare of California HMO Customer Service at 877-669-3855

SignatureValue Harmony HMO is a network-only plan available to employees and their families who live in select ZIP codes in California. To see if you are eligible for the SignatureValue Harmony HMO, visit the benefits enrollment site.

Details

- No deductible.

- Except for emergencies, benefits are paid only for care or services provided inside the network and when authorized through your Primary Care Physician (PCP).

- Access to the SignatureValue Harmony network for in-network benefits. This is a distinct subnetwork of UHC’s full HMO network of participating physician groups.

- You pay 20% coinsurance for some services

- Your PCP will coordinate all of your care, including referrals to specialists. In most cases, if you see a specialist without a referral from your PCP, it will not be covered.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

And more!

- Prescription drug coverage is provided through the network retail pharmacies and OptumRx home delivery service pharmacy.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Contact Us

- Call UnitedHealthcare of California HMO Customer Service at 877-669-3855

WellMed 1st Tier Plan is a network-only medical plan available to WellMed business unit employees and their families who live in certain ZIP codes or work in certain locations in the San Antonio, Texas, service area. To see if you are eligible for the WellMed 1st Tier Plan, visit the benefits enrollment site.

Details

- Except for emergencies, benefits are paid only for care or services provided inside the network.

- It is recommended that you choose a primary care physician (PCP) who will work with you to coordinate your care.

- You get the highest level of benefits when you use a Tier 1 PCP. Tier 1 physicians are recognized as providing high-quality care at a cost-effective price – in other words, the best value.

- Look for the Tier 1 'Blue Dot' symbol when searching the network for a PCP to ensure you are selecting a Tier 1 provider.

- Tier 1 includes WellMed-affiliated providers who participate in the UnitedHealthcare Choice Plus Network.

Prescription Drug Coverage

The WellMed 1st Tier Plan uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at 800-357-1371 for more information.

UnitedHealthcare of Nevada HMO is a network-only medical plan and is available to employees who live in Las Vegas, Nevada. Adobe zii 2018 mac download. To see if you are eligible for the UnitedHealthcare of Nevada HMO Plan, visit the benefits enrollment site.

Details

- Except for emergencies, benefits are paid only for care or services provided inside the network.

- Your PCP will coordinate all of your care, including referrals to specialists. In most cases, if you see a specialist without a referral from your PCP, it will not be covered.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

And more!

- Prescription drug coverage is provided through network retail pharmacies and a home delivery service.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Contact Us

- Call UnitedHealthcare of Nevada at 877-291-4894

UnitedHealthcare of Nevada POS combines elements of an HMO and PPO and is available to employees and their families who live in select ZIP codes in Las Vegas or Reno, Nevada. To see if you are eligible for the UnitedHealthcare of Nevada POS Plan, visit the benefits enrollment site.

Details

- You can choose to receive care from HMO providers (Tier 1), PPO providers (Tier 2) or out-of-network providers (Tier 3). The level of benefit you receive is determined by your choice of provider.

- Your deductible and copays depend on the tier you choose when you receive care.

- You receive the highest benefit when you choose a Tier 1 PCP.

- Your PCP will coordinate all of your care, including referrals to specialists. In most cases, if you see a specialist without a referral from your PCP, it will not be covered.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

And more!

- Prescription drug coverage is provided through network retail pharmacies and a home delivery service.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Contact Us

- Call UnitedHealthcare of Nevada at 877-291-4894

The Hawaii Preferred Provider Organization (PPO) is available to employees and their families if they live in Hawaii.

Details

- You can see any provider, but you'll save when you use a provider who participates in the Hawaii PPO network.

- You will generally pay 10% coinsurance for in-network services.

Prescription Drug Coverage

- The Hawaii Preferred Provider Organization (PPO) uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

- There is a separate out-of-pocket maximum for prescription drugs of $4,200 per individual and $5,750 for family.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

The Accountable Care Plan is a network-only plan available to eligible employees and their families in select locations based on your home ZIP code.

An Accountable Care Organization (ACO) gives you access to a value-based, focused network of providers, hospitals and other health care professionals who work together to provide you coordinated, high-quality, cost-effective care. The fundamental purpose of a high-performing ACO is to help you achieve better health outcomes.

To see if you are eligible for the Accountable Care Plan, visit the benefits enrollment site.

Details

- Except for emergencies, benefits are paid only for care or services received from providers in the Nexus network. There is no coverage for out-of-network services.

- You and each enrolled dependent must select a primary care physician (PCP).

- You get the highest level of benefits when you use a Tier 1 PCP and Tier 1 specialist. Tier 1 physicians are recognized as providing high-quality care at a cost-effective price – in other words, the best value.

- Look for the Tier 1 'Blue Dot' symbol when searching the network for a PCP to ensure you are selecting a Tier 1 provider.

- For non-Tier 1 PCP and specialist visits, you pay the full cost until you’ve met your deductible. Then you’ll pay 50% coinsurance.

- Your PCP will coordinate all of your care, including referrals to specialists. In most cases, if you see a specialist without a referral from your PCP, it will not be covered.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

- If you cover a child who lives out of state, call Health Care Advisor to request a PCP assignment in the state they live.

Prescription Drug Coverage

- The Accountable Care Plan uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network.

- Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at

800-357-1371 for more information.

The Bind Plan is available to eligible employees and their families in select locations based on your home ZIP code.

Bind is on-demand health insurance with no deductible. The Bind Plan offers price transparency and customizability to fit your healthcare needs. You can find out the total cost of care and what your copay will be before you obtain care via the Bind app. You can also see when you might be able to save money by selecting a different provider or service location.

To see if you are eligible for the Bind Plan, visit the benefits enrollment site.

Details

- Generally, when you obtain care, all of your costs are bundled and you pay only one price for that care. The plan pays the rest.

- With this plan you get preventive, primary, specialty, urgent, emergency and hospital care and prescriptions. Coverage also includes care for chronic conditions, cancer and maternity. Prices will vary based on your recommended care plan and where you receive care.

- Bind uses the UnitedHealthcare Choice Plus network. You have coverage both in- and out-of-network, but you pay less for care when you use an in-network provider. Note: there are variances in the Choice Plus network with Bind. This includes, but may not be limited to, the PHCS network in Buffalo, N.Y. Be sure to research your providers and facilities at choosebind.com/uhg. (access code UHG2021)

- You do not need:

- To select a primary care physician (PCP)

- A referral for services

- Bariatric surgery and infertility treatments are not covered under this plan.

- With the Bind Plan, you can adjust your coverage if your health care needs change. Activate coverage at any time of the year – at least three days in advance of a procedure – for 44 plannable procedures that vary in cost, treatment and setting.

- Procedures that require activation are paid for through additional paycheck contributions for a set duration. You may also pay a clear price to your provider, which varies based on the procedure and provider or location you select.

- The procedures that require activation are for things most people don’t need annually, such as endoscopy, knee replacement, tonsillectomy/adenoidectomy and ear tubes. Check choosebind.com/uhg (access code UHG2021) for a full list of these procedures.

Prescription Drug Coverage

The Bind Plan uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network. Visit Prescription Drug Coverage to learn more.

And more!

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Contact Us

- If you are currently enrolled in the Bind Plan:

- Employees log in to mybind.com

- Spouse or domestic partner log in to mybind.com

- New employees visit choosebind.com/uhg and enter access code UHG2021.

- Call the Bind Help Team at 855-472-7778, from 6 a.m. to 7 p.m. CT, Monday through Friday.

Monument Health 2000/4000 is available to employees and their families who live in select ZIP codes in Grand Junction, Colorado. To see if you are eligible for the Monument Health Plan, visit the benefits enrollment site.

Details

- You have the choice between a Tier 1 or Tier 2 provider. You get the highest level of benefits when you use a Tier 1 PCP.

- Tier 1: Monument Health Network (most coordinated and lowest cost for care) includes six Mesa County primary care practices to serve as your medical home, including more than 125 primary care providers; two local hospitals (St. Mary's Medical Center and Colorado Canyons Hospital & Medical Center); many local specialists who are either independently owned or affiliated with St. Mary's Medical Center or Family Health West; and all SCL Health providers and facilities in Denver and surrounding counties.

- Tier 2: Includes the Rocky Mountain Health Plan statewide network of providers.

- Generally, when you obtain care, all of your costs are bundled and you pay only one copay for that care. Your plan pays the rest.

- Separate deductible amounts for Tier 1 and Tier 2. Tier 1 and Tier 2 out-of-pocket maximums are combined.

- Out-of-network coverage is provided, but you will pay more for those services. All out-of-network services have separate deductibles and out-of-pocket maximums.

And more!

- Learn more about Rocky Mountain Health Plans' Wellness Program.

- Prescription drug coverage is provided through network retail pharmacies and a home delivery service.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Resources

- Call Rocky Mountain Health Plans at 800-843-0719

- Manage your claims and access information regarding services provided through your medical plan by creating an account at rmhp.org.

- Find Tier 1 and Tier 2 providers at rmhp.org.

The Doctors Plan is a network-only plan available to employees and their families who live in certain ZIP codes in Denver, Colorado. It is built around deepening the relationship between you and your primary care physician (PCP). To see if you are eligible for the Doctors Plan, visit the benefits enrollment site.

Details

- Except for emergencies, benefits are paid only for care or services received from providers in the network. There is no coverage for out-of-network services.

- This plan helps you save money on your health care costs because it has a low premium and no copays for PCP office visits, urgent care, convenience care or Virtual Visits.

- For other services like minor X-ray and lab tests, you'll pay a $25 copay

- You and each enrolled dependent must select a PCP in the Doctors Plan network.

- You will have access to PCPs including those from Centura Health, Colorado Health Neighborhoods, New West Physicians and other community physicians.

- Your PCP will coordinate all of your care. For services within the network, no referral is required.

- Additional coordination is required if you cover a dependent who lives out of state. Your dependent must have a PCP in the state where you reside.

- You will have access to PCPs including those from Centura Health, Colorado Health Neighborhoods, New West Physicians and other community physicians.

Prescription Drug Coverage

- The Doctors Plan uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network.

- Visit Prescription Drug Coverage to learn more.

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at 800-357-1371 for more information.

The M Health Fairview Primary Care Plan is a network-only plan available to eligible employees and their families who live in certain ZIP codes in Minneapolis and St. Paul, Minnesota.

The M Health Fairview Primary Care Plan is an Accountable Care Organization (ACO). An ACO gives you access to a value-based, focused network of providers, hospitals and other health care professionals who work together to provide you coordinated, high-quality, cost-effective care. The fundamental purpose of a high-performing ACO is to help you achieve better health outcomes.

Aetna Emergency Room Copay

With this plan, you’ll have access to over 4,000 doctors and other health care professionals from M Health Fairview and several popular independents like Voyage Healthcare (formerly North Clinic) and Entira Family Clinics.

To see if you are eligible for the M Health Fairview Primary Care Plan, visit the benefits enrollment site.

Details

- Except for emergencies, benefits are paid only for care or services received from providers in the Fairview medical group, its affiliated hospitals and other facilities in the network. There is no coverage for out-of-network services.

- This plan helps you save money on your health care costs because it has a low premium and low office visit copays and deductibles.

- With this plan, you and your family will have access to Fairview's hospital partners, including University of Minnesota Health and North Memorial Health.

- You do not need:

- To select a primary care physician (PCP)

- A referral for services if you see a provider within the Fairview network

Prescription Drug Coverage

- The M Health Fairview Primary Care Plan uses the OptumRx Select Network. This network includes 50,000 pharmacies such as major drug stores, mass retailers, local pharmacies and supermarkets, as well as home delivery and specialty pharmacy services. Please note that CVS does not participate in the OptumRx Select Network.

- Visit Prescription Drug Coverage to learn more

And more!

- You have access to Health Care Advisor, your 24/7 resource for personalized health care support and guidance.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

- When you use a UnitedHealthcare Hearing provider, the plan will pay 80% after the deductible for an assessment and hearing aids with a maximum benefit of $3,000 every three years. Call Health Care Advisor at

800-357-1371 for more information.

SignatureValue Advantage is a network-only HMO available to employees and their families who live in select ZIP codes in California. To see if you are eligible for the SignatureValue Advantage HMO, visit the benefits enrollment site.

Details

- No deductible.

- Except for emergencies, benefits are paid only for care or services provided inside the network and when authorized through your Primary Care Physician (PCP).

- Access to SignatureValue Advantage performance network.

- You pay 20% coinsurance for some services

- Your PCP will coordinate all of your care, including referrals to specialists. In most cases, if you see a specialist without a referral from your PCP, it will not be covered.

- You do not need in-network referrals for certain services such as:

- Obstetricians/gynecologists

- Behavioral health and substance-use disorder clinicians

- Convenience care clinics, urgent care clinics or emergency rooms

And more!

- Prescription drug coverage is provided through the network retail pharmacies and OptumRx home delivery service pharmacy.

- Contribute to a Full-Purpose Health Care Flexible Spending Account (FSA) to help cover eligible medical, dental and vision costs with pretax dollars.

Resources

- Call UnitedHealthcare of California HMO Customer Service at 877-669-3855.

Original Medicare is a federal health insurance program for seniors and people with certain disabilities. When a Medicare recipient requires emergency care, Medicare does cover emergency room visits for the most part, and the recipient pays a copayment.

Read on to learn more about emergency room costs and how a Medicare Supplement Insurance plan can help reduce what you pay out of pocket for Medicare emergency room coverage.

What is the Copay for Medicare Emergency Room Coverage?

A copay is the fixed amount that you pay for covered health services after your deductible is met. In most cases, a copay is required for doctor’s visits, hospital outpatient visits, doctor’s and hospital outpatients services, and prescription drugs. Medicare copays differ from coinsurance in that they're usually a specific amount, rather than a percentage of the total cost of your care.

Medicare does cover emergency room visits. You'll pay a Medicare emergency room copay for the visit itself and a copay for each hospital service. It is important to remember, however, that your actual Medicare urgent care copay amount can vary widely, depending on the services you require and where you receive care.

If you are admitted for inpatient hospital services after an emergency room visit, Medicare Part A does help cover costs for your hospital stay. Medicare Part A does not cover emergency room visits that don't result in admission for an inpatient hospital stay.

What Does Medicare Pay for Emergency Room Visits?

Medicare Part A emergency room coverage is specifically for inpatient hospital stays. If your emergency room visit requires you to be admitted for inpatient care, your Medicare Part A benefits would kick in but are subject to the Part A deductible and coinsurance.

Most ER services are considered hospital outpatient services, which are covered by Medicare Part B.They include, but are not limited to:

- Emergency and observation services, including overnight stays in a hospital

- Diagnostic and laboratory tests

- X-rays and other radiology services

- Some medically necessary surgical procedures

- Medical supplies and equipment, like splints, crutches and casts

- Preventive and screening services

- Certain drugs that you wouldn't administer yourself

NOTE: There's an important distinction to be made between inpatient and outpatient hospital statuses. Your hospital status affects how much you pay for services. Unless your doctor has written an order to admit you as an inpatient, you're an outpatient, even if you spend the night in the hospital.

How Medicare Part B Pays For Outpatient Services

Medicare Part B pays for outpatient services like the ones listed above, under the Outpatient Prospective Payment System (OPPS). The OPPSpays hospitals a set amount of money (or payment rate) for the services they provide to Medicare beneficiaries.

The payment rate varies from hospital to hospital based on the costs associated with providing services in that area, and are adjusted for geographic wage variations.

Other Medicare Costs

Aside from Medicare ER copays, there are other outpatient hospital costs that you should be aware of when visiting the emergency room, such as deductibles and coinsurance. In most cases, if you receive care in a hospital emergency department and are covered by Medicare Part B, you'll also be responsible for:

- An annual Part B deductible of $203 (in 2021).

- A coinsurance payment of 20% of the Medicare-approved amount for most doctor’s services and medical equipment.

How You Pay For Outpatient Services

In order for your Medicare Part B coverage to kick in, you must pay the yearly Part B deductible. Once your deductible is met, Medicare pays its share and you pay yours in the form of a copay or coinsurance. Download adobe photoshop for mac yosemite.

Get Help Covering Your Emergency Room Copay

If you're worried about a trip to the emergency room adding expensive and unpredictable costs to your health care budget, consider joining a Medicare Supplement Insurance (or Medigap) Plan. Medigap is private health insurance that Medicare beneficiaries can buy to cover costs that Medicare doesn't, including some copays. All Medigap plans cover at least a percentage of your Medicare Part B coinsurance or ER copay costs.

To find a Medigap plan in your area, call 1-800-995-4219 to connect with a licensed insurance agent.

Does Medicare Part A cover emergency room visits?

If you opted out of Medicare Part B, and only have Part A, you may be wondering if you can get coverage for an emergency room visit. Medicare Part A is designed for hospital insurance, meaning that it's benefits are generally used once admitted to the hospital.

Medicare Emergency Room Copay

Resource Center

What Does Emergency Room Copay Cover

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

Does Unitedhealthcare Community Plan Cover Emergency Room Visits

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

United Healthcare Emergency Room Copay

We've been helping people find their perfect Medicare plan for over 10 years.

United Healthcare Emergency Care

Ready to find your plan?